How To Input A. Opening Balance In Quickbooks Register

Learn how to enter an opening balance for a bank, credit card, and other types of accounts.

When y'all create a new account in QuickBooks Desktop, pick a day to start tracking all of your transactions. Y'all enter the balance of your real-life banking company account for the solar day you pick. This manner, QuickBooks matches your bank records from the start.

This starting betoken is the business relationship'south opening residual. Information technology summarizes all the past transactions that came before information technology. Here's how to enter an opening balance for accounts y'all create in QuickBooks.

Pace ane: Enter an opening balance

Follow the steps for the blazon of business relationship the opening remainder is for:

Bank or credit card accounts

Before yous create a new business relationship on your QuickBooks Nautical chart of Accounts, make sure you know what to enter for your opening balance .

Y'all can enter an opening balance for a real-life depository financial institution account you just created, or i you've had for a while.

- Get your bank statements or sign in to your bank's website.

- In QuickBooks Desktop, go to the Company carte du jour and then select Nautical chart of Accounts.

- Correct-click anywhere on your Chart of Accounts and select New.

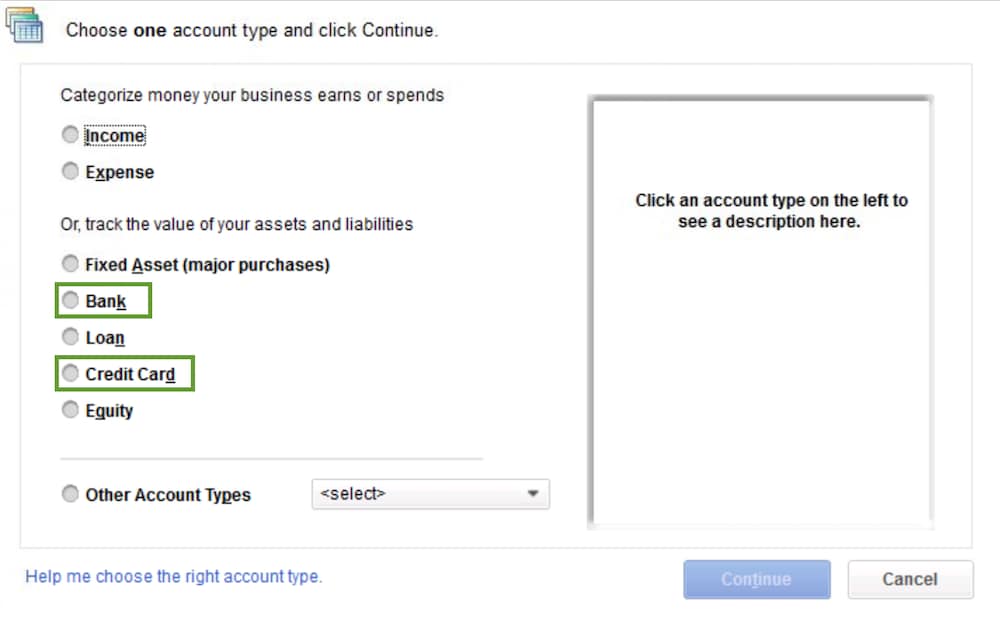

- SelectBank or Credit Card for the account type. So select Continue.

- Requite your account a proper name. If y'all have multiple accounts of the aforementioned type or at the same bank, give them unique names so they're easy to tell apart.

- Fill out the rest of the data fields.

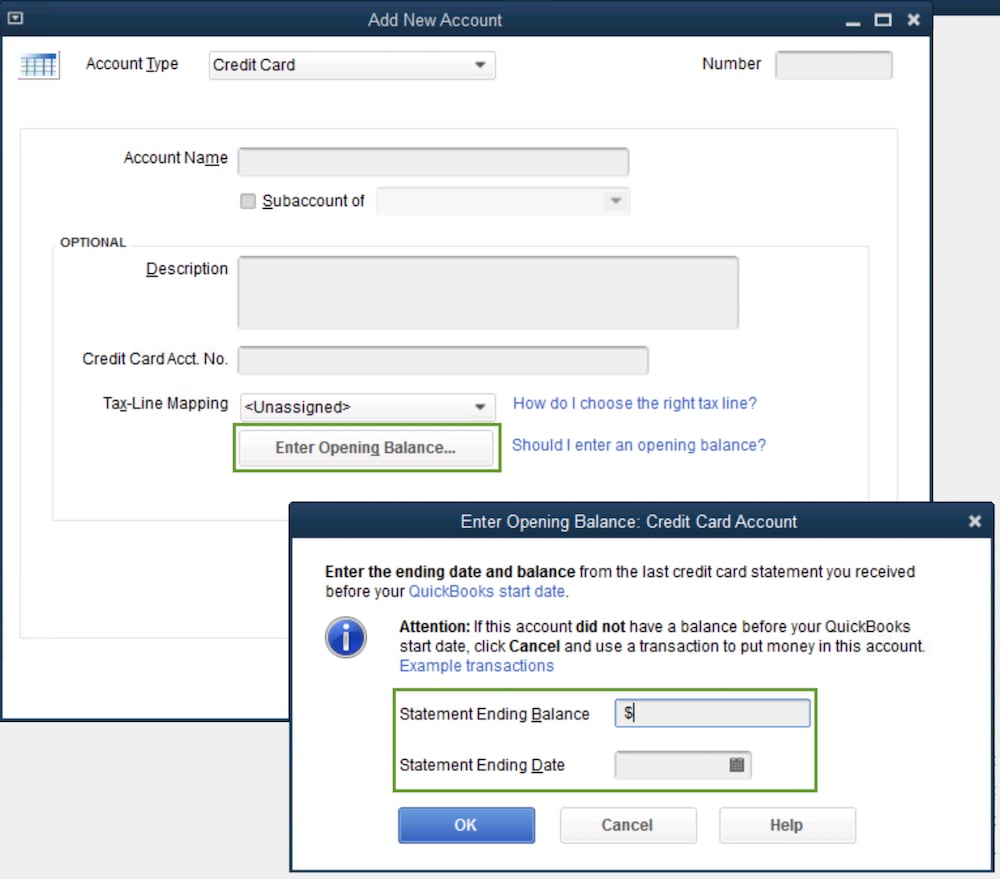

- Select Enter Opening Balance. Later on, if y'all need to edit your opening residual, the button will be Change Opening Balance.

What you enter as the opening balance depends on how you want to handle your by transactions:

What you enter as the opening balance depends on how you want to handle your by transactions:- If you lot don't program to enter older transactions that come before the opening balance date in QuickBooks: Enter the catastrophe balance and ending appointment from your most recent bank argument. Then select OK. This summarizes all of your past transactions. You lot'll start tracking new transactions going forward.

- If you want to enter your by transactions in particular: Decide how far back you want to go. Choice a engagement that's older than the oldest transaction you want to runway in QuickBooks. Your opening balance summarizes everything earlier the date you lot pick. Enter the date you picked in the Catastrophe date field. In the Ending balance field, enter the rest of your existent-life account for that date. Then select OK. This method prevents you from counting past transactions twice.

- When y'all're done, select Relieve & Close to tape the opening rest.

Handle pending or outstanding payments:

Asset, liability, and other types of accounts

Y'all can enter an opening balance for a real-life bank account yous just created, or i y'all've had for a while.

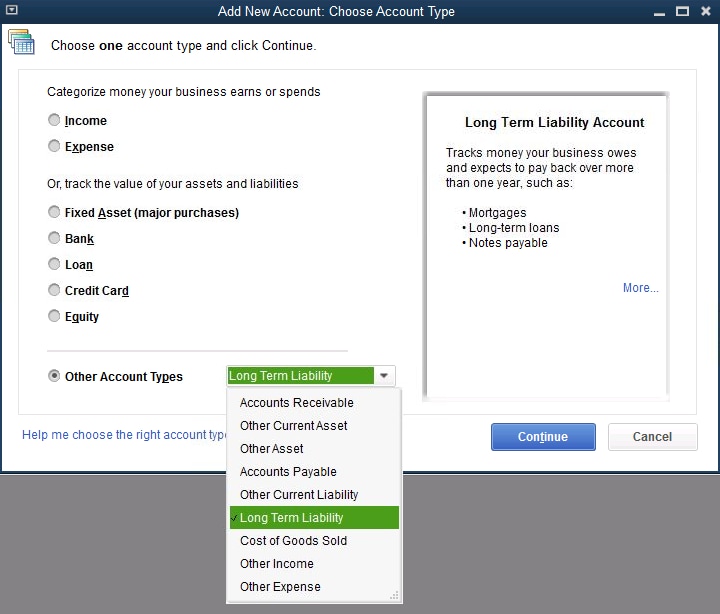

Be careful entering the opening balances for accounts on your Rest Canvass. This includes Fixed Asset, Equity, Long-term Liability, Other Assets, Other Current Asset, and Other Current Liability accounts.

If you're unsure or have questions, reach out to your accountant. If yous don't have an auditor, nosotros can help yous find one :

- Become your bank statements or sign in to your bank's website.

- In QuickBooks Desktop, go to the Company menu and so select Chart of Accounts.

- Right-click anywhere on your Chart of Accounts and select New.

- Select Stock-still Nugget, Loan, or Equity. For other types of accounts, select the Other Business relationship Types drop-downwards and 1 of the types. Then select Continue.

- Give your account a proper name. If you take multiple accounts of the aforementioned type or at the same bank, give them unique names so they're easy to tell autonomously.

- Fill out the rest of the information fields.

- Select Enter Opening Balance. Later, if y'all demand to edit your opening balance, the push will be Alter Opening Balance. What you enter for the opening rest depends on how you want to handle your past transactions:

- If you lot don't program to enter older transactions that come before the opening residue date in QuickBooks: Enter the catastrophe residuum and catastrophe engagement from your virtually recent bank statement. Then select OK. This summarizes all of your past transactions. You'll start tracking new transactions going forward.

- If you want to enter your past transactions in detail: Make up one's mind how far back you want to get. Choice a engagement that's older than the oldest transaction yous want to runway in QuickBooks. Your opening balance summarizes everything before the date you option. Enter the date yous picked in the Ending date field. In the Catastrophe balance field, enter the balance of your existent-life account for that date. Then select OK. This method prevents you from counting by transactions twice.

- When y'all're done, select Save & Close to record the opening balance.

Alternative: Create a journal entry for the opening balance

Income and expense accounts

You don't demand to enter opening balances for income or expense accounts. These accounts simply track your earnings and spending.

Customer or vendor balances in Accounts Payable and Accounts Receivable

If your customers or vendors have outstanding balances from before your opening rest date, enter the private unpaid invoices or bills. This creates open up balances that collectively effect in your Accounts Payable and Accounts Receivable opening balances.

Pace 2: Bank check the opening rest entry

After you enter the opening residue, get to your account annals and make certain it'due south accurate. The Opening Balance Equity account shouldn't have a remaining balance.

- Go to theLists menu and selectChart of Accounts.

- Search for and open theOpening Remainder Equity account.

- Check the account balance. Information technology should be 0.00.

If the balance isn't 0.00, don't worry. Write downwards the remaining balance. Then run a Residue Sheet Report for concluding year.

- Go toReports and hover overCompany & Financial.

- SelectResidual Sheet Standard.

- From theDates dropdown, selectLast Fiscal Year.

- In the Equity section, check theRetained Earnings balance.

- Compare last yr's Retained Earnings balance with the remaining balance in the Opening Remainder Disinterestedness account.

If they match, y'all're good to become. Everything is balanced. If they don't lucifer, attain out to your accountant. They know how to go your accounts back in balance.

How To Input A. Opening Balance In Quickbooks Register,

Source: https://quickbooks.intuit.com/learn-support/en-us/help-article/product-setup/enter-opening-balances-accounts-quickbooks-desktop/L4PfiNhRx_US_en_US

Posted by: valazquezmrsentlittly.blogspot.com

0 Response to "How To Input A. Opening Balance In Quickbooks Register"

Post a Comment