Can I Manage Money For A Fee Without Being Registered?

Wise, formerly Transferwise is a new blazon of financial company launched in 2011 past two Estonian friends who realised that they were paying too much for international money transfers. Since and then, they have revolutionised the way in which people transfer coin across borders and have been backed by investors who believed in their idea, such as Paypal co-founder Peter Thiel and Virgin's founder Richard Branson.

Run across how Time Doctor's piece of cake-to-apply time tracking software tin can assistance your squad be more productive.

More than one million people around the world use Wise and they send $1.v million every month. By doing then, they save $2 million every day considering Wise'due south applied science allows them to transfer money overseas using the real substitution rate and a small, upfront fee. It is cheaper to apply that other providers because the transfers are actually made through local banking company accounts, which means that money doesn't actually cross borders.

Because of this, more people are exploring how to transfer coin using Wise, and we'll testify you how to do that in this guide.

Is it an alternative to PayPal?

Transferring via PayPal costs a minimum of four.5% when transferring money across borders. MassPay, their cheapest method charges a 2% fee and then adds an boosted 2.5% currency transfer fee.

Yep, that's a total of 4.5% that you are charged with the transfer fee and the currency transfer fees, which virtually times y'all'll find out virtually after y'all make the transfers.

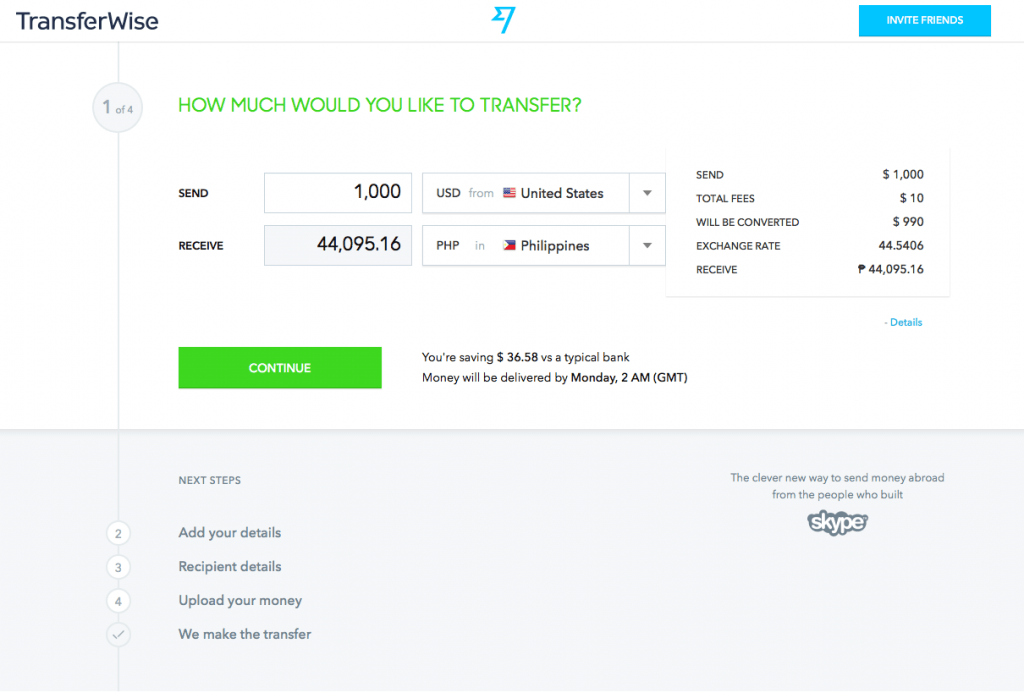

If you send $yard abroad PayPal charges y'all $45. By using Wise you are only charged a maximum of 1% for the transfer and no subconscious fee for the currency exchange which means the total toll is $10. That's quite a departure!

Here's how the money transfer market works

Every bank and nigh every money transfer company such every bit Western Union make their coin from a hidden currency exchange fee. Wise does not have whatsoever hidden fees and they declare all their fees upfront:

- 1% for transfers from the US in USD

- 0.5% for about other transfers

- 1% for some currencies, such every bit the Philippine Peso

More about hidden currency commutation fees. If you're not certain what I mean past "subconscious currency conversion" bank check out our explanation in this article.

Which countries can you transfer money from and to? (updated July 2017)

| Uk | Republic of croatia | Norway |

| Euro | Czechia | Poland |

| Us | Denmark | Romania |

| Australia | Hong Kong | Singapore |

| Brazil | Hungary | Sweden |

| Bulgaria | Japan | Switzerland |

| Canada | New Zealand |

Here are the countries that you tin can transfer to:

| Bangladesh | Malaysia | Due south Korea |

| Chile | United mexican states | Sri Lanka |

| China | Morocco | Thailand |

| Republic of colombia | Islamic republic of pakistan | Turkey |

| Georgia | Peru | United Arab Emirates |

| Republic of indonesia | Philippines | Ukraine |

| India | Russia | Vietnam |

| Israel | Due south Africa |

How does it piece of work?

It's really uncomplicated! What you have to practise is go to their website, gear up up a transfer and create an business relationship. You can start hither by using the calculator below.

Then they volition confirm the transfer corporeality and show you the exact exchange rate then add together your details:

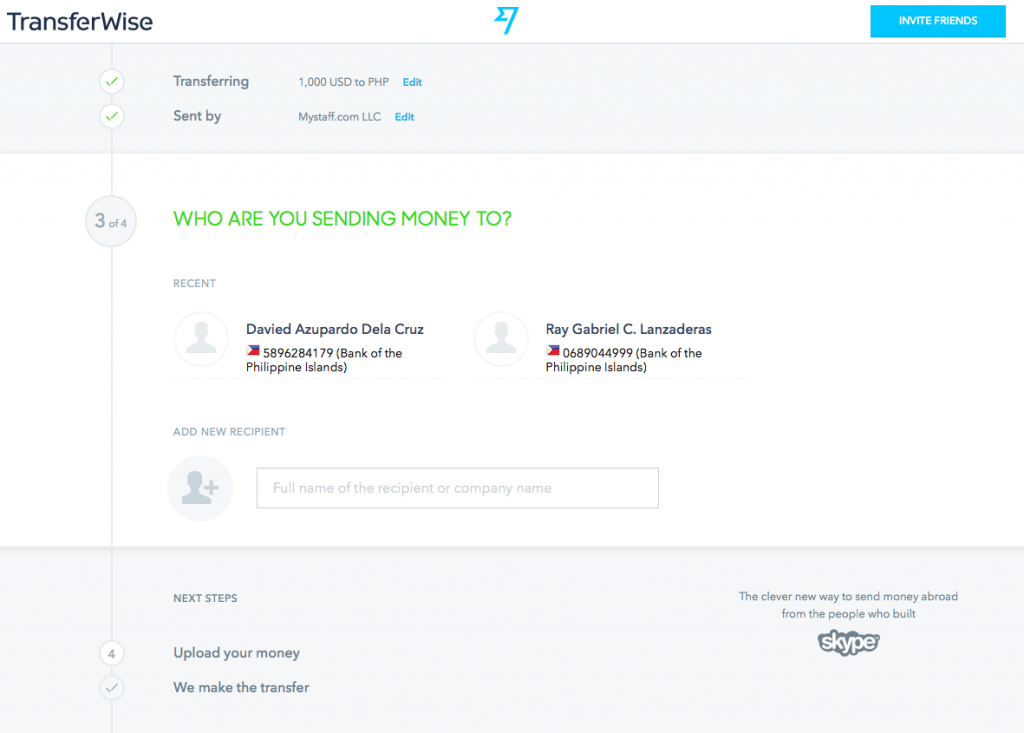

Y'all can select a previous recipient or add a new recipient:

The last footstep is for y'all to ship the money to Wise.

There are a few means y'all tin can do this, each with their own benefits and disadvantages.

The fastest option is paying past debit or credit card. The money volition get to Wise almost instantly so they tin starting time converting information technology for you lot correct abroad. There is an additional fee for credit cards, however, and this method can only exist used for amounts up to $1,000.

Yous can likewise pay by direct debit, which allows you lot to connect your online banking directly to Wise, formerly TransferWise. This method comes with no extra fees and it'southward pretty convenient. You'll verify your details using your online banking username and countersign and, in some cases, micro-deposits sent to your account. Direct debit will get your money to Wise in anywhere from i-3 working days and can be used to send upward to $10,000.

If you want to send more than $10,000, you'll have to brand a local wire transfer. The downside to this is that your bank will probably accuse you an additional fee when y'all have them wire the money from your account to Wise'due south, merely it's pretty fast; your coin will get to Wise in a few working hours. You can likewise ship upwardly to $1,000,000 per transfer when you're sending your money by wire.

Whether yous choose banks, Paypal or meliorate alternatives to Paypal, there are different options available. However, if you want a reliable and fairly priced provider which will relieve you money, we recommend you Wise, formerly Transferwise.

Rob Rawson is a co-founder of Time Doctor which is software to improve work productivity and help keep track of what your squad is working on, even when working remotely.

Source: https://www.timedoctor.com/blog/transferring-money-transferwise/

Posted by: valazquezmrsentlittly.blogspot.com

0 Response to "Can I Manage Money For A Fee Without Being Registered?"

Post a Comment